Can AI predictive account scoring transform how you identify and prioritize high-value accounts before your competitors even know they’re in-market? Today’s revenue teams face mounting pressure to focus limited resources on accounts most likely to convert while eliminating wasted effort on low-probability prospects.

AI predictive account scoring has emerged as a game-changing capability for modern ABM and demand generation strategies. This advanced approach uses machine learning algorithms to analyze vast amounts of data and automatically identify which accounts show the highest propensity to purchase.

This comprehensive guide will walk you through everything you need to know about implementing AI predictive account scoring to transform your revenue and demand generation operations.

What Is AI Predictive Account Scoring?

Predictive account scoring uses artificial intelligence and machine learning to evaluate accounts based on their likelihood to convert into customers. Unlike traditional lead scoring that focuses on individual contacts AI predictive scoring analyzes entire accounts across multiple dimensions.

Traditional lead scoring relies on manually assigned point values for specific actions or attributes. These rules-based approaches often fail to capture complex relationships between variables and struggle to adapt to changing market conditions.

AI predictive scoring represents a significant evolution. The technology continuously learns from historical conversion patterns and applies those insights to identify similar characteristics in new accounts. This creates a dynamic system that improves over time.

Predictive account scoring typically integrates with your existing technology stack. Most implementations connect with your CRM platform marketing automation system and customer data platforms to gather comprehensive signals across the entire buyer journey.

The true power comes from AI’s ability to process thousands of data points simultaneously and uncover hidden patterns that human analysts might miss. By leveraging machine learning algorithms, predictive scoring can identify which characteristics and behaviors truly correlate with successful outcomes. This is a vital component for comprehensive AI for ABM orchestration.

5 Benefits of Predictive Account Scoring

1. Align Marketing & Sales on ICP Priorities

Predictive scoring creates a single source of truth for account prioritization. This eliminates subjective debates between marketing and sales about which accounts deserve attention. Both teams can rally around the same data-driven insights.

The models provide objective validation of your ideal customer profile. They uncover which characteristics truly predict success rather than relying on assumptions or historical biases. This creates alignment across the entire revenue organization.

Marketing can focus resources on engaging high-scoring accounts with targeted content and campaigns. Sales can confidently prioritize their outreach efforts knowing they’re pursuing accounts with the highest probability of conversion.

2. Raise Conversion and Close-Won Rates

When you focus on accounts with higher predictive scores your conversion metrics improve dramatically. Teams stop wasting time on poor-fit accounts that were never likely to convert in the first place.

Multiple studies have shown significant improvements after implementing predictive scoring. Forrester Research found that B2B organizations using predictive analytics saw a 4-5x increase in lead-to-opportunity conversion rates and 3x higher close rates.

The continuous learning aspect of AI models means they get smarter over time. As more conversion data feeds back into the system accuracy improves further enhancing results.

3. Shorten Deal Cycles with Earlier Engagement

Predictive scoring helps identify accounts showing early buying signals before they’ve formally entered the market. This allows your team to engage earlier in the buying process when you can shape requirements rather than competing against established criteria.

Early engagement gives you a competitive advantage. You can educate prospects on your unique approach before competitors have a chance to position themselves. This often leads to faster deal cycles and higher win rates.

The time savings extend across the entire revenue process. Marketing stops nurturing low-probability accounts and sales reps avoid lengthy pursuits of deals unlikely to close. Everyone focuses where impact is highest.

4. Optimize Program Spend Toward High-Propensity Accounts

With predictive scoring you can allocate marketing budget more effectively. Instead of spreading resources evenly you can concentrate investment on the accounts most likely to convert.

This optimization applies across all channels. Your paid media targets high-scoring accounts. The content strategy addresses their specific challenges and your event budget prioritizes regions with clusters of high-value prospects.

The ROI improvements can be substantial. Companies implementing predictive account scoring report 40-60% improvements in customer acquisition costs as resources shift away from low-probability targets.

This can also be leveraged in ABM orchestration across multiple platforms such as LinkedIn Ads, Google Ads and Meta Ads.

5. Provide Data-Backed Coaching & Accountability for Reps

Predictive scoring creates objective performance benchmarks for sales teams. Managers can see which reps effectively convert high-scoring accounts and which might need additional coaching or support.

The data helps identify best practices. By analyzing what top performers do differently with similar account scores organizations can develop repeatable playbooks that improve results across the entire team.

The system also provides accountability. When high-scoring accounts aren’t properly pursued managers can intervene with targeted coaching rather than discovering missed opportunities months later.

How Predictive Account Scoring Works

1. Profile & Segment Target Accounts

The process begins with defining your market and establishing basic firmographic parameters. This might include industry company size geographic location and other fundamental attributes that define your addressable market.

Many organizations start with their total addressable market and then apply initial filters. This creates a foundation of accounts that meet basic criteria before applying more sophisticated scoring.

The segmentation approach varies by business model. Enterprise-focused companies might segment by industry and company size while SMB-focused businesses might prioritize growth signals or technology adoption indicators.

2. Enrich With External & Intent Signals

Basic firmographic data provides only a partial picture. Effective predictive scoring requires enriching your account data with additional signals from multiple sources. This creates a comprehensive view of each account’s buying potential.

Technographic data reveals what technologies accounts currently use. This helps identify integration opportunities compatibility needs and potential competitive displacement scenarios.

Intent data shows research activities that indicate buying interest. This includes content consumption search behaviors and engagement with industry resources related to your solution category.

Additional signals might include:

- Product usage data for freemium or trial users

- Website engagement patterns

- Event attendance or webinar participation

- Recent funding rounds or executive changes

- Competitor contract renewal dates

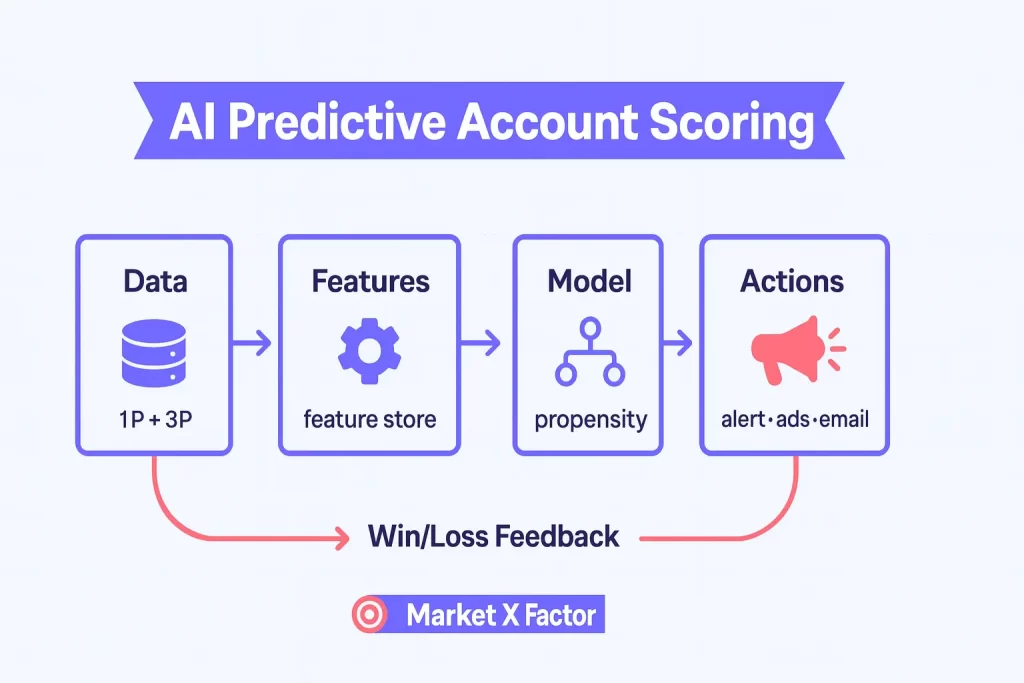

3. Train ML Models

With comprehensive data in place the next step involves training machine learning models to recognize patterns that predict conversion. This process typically includes several components.

Feature engineering identifies which data elements have predictive power. Data scientists transform raw data into features that help the algorithm recognize important patterns.

Algorithm selection determines which type of machine learning approach best fits your specific scenario. Options might include logistic regression random forests gradient boosting or neural networks depending on your data characteristics.

Cross-validation ensures the model performs consistently across different data segments. This helps prevent overfitting where a model works well on training data but fails with new accounts.

The training process requires historical data that includes both successful and unsuccessful outcomes. Models learn by analyzing what factors differentiated accounts that converted versus those that didn’t.

4. Classify Sales-Ready Accounts

Once trained the model generates probability scores for each account. These scores typically represent the likelihood of conversion within a specific timeframe.

Most organizations establish threshold scores that trigger different actions. For example accounts above 80% probability might receive immediate sales outreach while those between 60-80% enter nurture campaigns.

Many implementations use grade buckets for simplicity. Rather than communicating raw probability percentages they translate scores into categories like A+ A B C or Hot Warm Cold for easier consumption by sales teams.

The classification should align with your go-to-market strategy. Enterprise sales might use different thresholds than velocity sales models since the opportunity cost and resource requirements differ significantly.

5. Prioritize & Activate

The final stage involves operationalizing predictive scores across your revenue process. This includes integrating scores into workflows automating actions based on scores and measuring the business impact.

Common activation approaches include:

- Automatic routing of high-scoring accounts to appropriate sales representatives

- Triggering specific outreach sequences based on score ranges

- Adjusting marketing campaign targeting to focus on high-potential accounts

- Integrating scores into sales dashboards and opportunity management

- Creating alerts when account scores change significantly

The activation strategy should include feedback mechanisms. As teams take action based on scores outcomes should feed back into the system to continuously improve model accuracy.

What Data Powers Predictive Account Scoring?

Firmographic Data

Firmographic data forms the foundation of most predictive scoring models. This includes basic company information that helps establish fit with your ideal customer profile.

Key firmographic elements include:

- Industry classification and sector

- Company size by revenue or employee count

- Geographic locations and market presence

- Company age and growth trajectory

- Legal structure and ownership model

The predictive power of firmographics varies by solution. Enterprise software providers might find company size highly predictive while specialized industry solutions might weight sector-specific attributes more heavily.

Technographic Footprint

Technographic data reveals the technology ecosystem within target accounts. This provides critical context about technical compatibility integration opportunities and potential displacement scenarios.

Important technographic signals include:

- Current tech stack composition

- Technology spending patterns

- Recent implementation projects

- Legacy system identification

- Contract renewal timelines

- Technology adoption profile (early adopter vs. laggard)

Technographics help identify accounts where your solution fills a specific gap or integrates well with existing investments. This often proves highly predictive of sales success.

Buying-Intent & Engagement Signals

ABM intent data and account engagement data capture active buying behaviors. These signals indicate when accounts are actively researching solutions like yours making them powerful predictors of near-term opportunities.

Key intent and engagement signals include:

- Topic-specific research activities

- Competitor website visits

- Industry content consumption

- Engagement with your marketing assets

- Email and ad campaign responses

- Product usage metrics for trials or freemium offerings

Intent signals often serve as timing indicators. While firmographics might show ideal fit intent data reveals which accounts are actively in-market and ready for engagement.

External Context

Contextual data provides additional insights about market conditions organizational changes and external factors that might influence buying decisions.

Valuable contextual signals include:

- Recent funding rounds or investments

- Executive leadership changes

- Merger and acquisition activity

- Regulatory changes affecting the account

- Economic factors specific to their industry

- Competitor pressures or market disruption

These external signals help identify trigger events that often precede buying decisions. AI models can learn which contextual changes most frequently lead to new opportunities.

Challenges & Considerations

Data Quality & Coverage Gaps

Predictive scoring models are only as good as the data that powers them. Incomplete or inaccurate data can significantly undermine model performance and lead to incorrect prioritization.

Common data challenges include:

- Missing firmographic information for certain market segments

- Inconsistent naming conventions across data sources

- Limited historical conversion data for new market entries

- Sparse engagement data for accounts with limited previous interaction

- Data decay as information becomes outdated

Organizations should assess data quality before implementation. This includes auditing existing data coverage identifying critical gaps and establishing processes for ongoing data hygiene.

Model Drift and Continuous Retraining Needs

Predictive models naturally degrade over time as market conditions customer preferences and competitive landscapes evolve. This phenomenon known as “model drift” requires ongoing attention.

Signs of model drift include:

- Decreasing conversion rates for high-scoring accounts

- Unexpected success with low-scoring accounts

- Changing patterns in feature importance

- Sales team feedback about inaccurate predictions

Effective implementations include regular retraining schedules. Models should be updated quarterly or biannually with fresh conversion data to maintain accuracy. Some advanced systems incorporate automated retraining based on performance metrics.

Privacy / Compliance (GDPR, CCPA)

Data privacy regulations create important constraints for predictive scoring implementations. Organizations must ensure their practices comply with relevant laws in all operating regions.

Key compliance considerations include:

- Proper consent for data collection and processing

- Transparency about how scores are calculated and used

- Data minimization principles to collect only necessary information

- Rights to access correct and delete personal information

- Limitations on automated decision-making that significantly affects individuals

- Data localization requirements for certain regions

Most implementations focus on company-level data rather than personal information to minimize compliance risks. However thorough legal review remains essential.

Change Management & Rep Adoption

Technical implementation represents only part of the challenge. Successful predictive scoring also requires organizational adoption particularly from sales teams who ultimately act on the predictions.

Common adoption challenges include:

- Skepticism from experienced reps who trust “gut feel” over AI

- Confusion about how scores are calculated or what they mean

- Resistance to changing established prioritization methods

- Lack of integration with existing sales workflows

- Insufficient training on how to interpret and use scores effectively

Effective change management strategies include:

- Clear communication about how scores work and their benefits

- Involvement of sales leaders in implementation planning

- Pilot programs with influential team members

- Performance incentives aligned with score-based prioritization

- Regular success stories highlighting wins from the new approach

Frequently Asked Questions

How does AI predictive account scoring differ from traditional lead scoring?

Traditional lead scoring focuses on individual contacts using simple point-based rules assigned manually. AI predictive account scoring evaluates entire organizations using machine learning algorithms that analyze thousands of data points simultaneously. While traditional scoring relies on assumptions about what matters AI models discover actual patterns in your conversion data.

Traditional systems remain static while AI continuously learns and improves. Account-based scoring aligns better with B2B buying processes where multiple stakeholders influence decisions not just individual leads.

What minimum data is required before an AI predictive model becomes reliable?

For basic predictive models you typically need 50-100 historical conversions and a similar number of non-conversions. Enterprise-grade models with higher accuracy require 200+ conversions for statistical significance. Quality matters more than quantity. Clean consistent data across your conversion examples improves model performance even with smaller datasets.

The model also needs sufficient account attributes and behavioral signals to find meaningful patterns. Most vendors can assess your data readiness and recommend enrichment strategies if needed before implementation.

Which AI scoring vendors integrate natively with major CRM and marketing platforms?

Several leading vendors offer native integrations with popular platforms. For Salesforce look at 6sense MadKudu and Salesforce’s own Einstein Lead Scoring. HubSpot users can leverage HubSpot’s built-in predictive scoring Infer or Lift AI. Marketo integrates well with Demandbase MadKudu and Lattice Engines.

Always verify current integration status directly with vendors as capabilities evolve rapidly. Many vendors also offer custom API integrations for specialized tech stacks.

How do I explain a predictive model’s score drivers to sales representatives?

Most modern scoring platforms include “explainability” features that identify which factors most influenced each account’s score. Use simple visualizations like radar charts or factor lists to show key drivers for each account. Translate technical model outputs into business-relevant insights sales reps can understand and act upon.

Create concrete examples showing how specific account characteristics relate to historical success patterns. Develop straightforward playbooks that connect score drivers to specific sales actions or conversation topics. Regular training sessions with real examples will build trust in the system over time.